Cash Loans: Smart Borrowing Practices

The Advantages of Deciding On Installation Loans for Your Following Major Acquisition

When considering a major purchase, several individuals ignore the benefits of installation lendings. These loans provide predictable month-to-month payments that can boost budgeting. They usually include reduced rates of interest than credit scores cards, which can alleviate financial stress. Additionally, customers can delight in clear funding terms and problems. Nevertheless, the benefits expand beyond simple numbers. Discovering these aspects can disclose just how installment financings might work as a strategic financial device.

Predictable Regular Monthly Settlements

When customers pick installment loans for major purchases, they gain from foreseeable monthly payments that simplify budgeting. This organized repayment strategy enables individuals to assign their funds properly, ensuring that they can satisfy their finance commitments without the anxiety of changing costs. Monthly, debtors understand exactly how much they require to reserve, lessening the risk of overspending and advertising liable financial behaviors

Furthermore, predictable settlements facilitate long-lasting preparation. Consumers can examine their month-to-month expenditures, consisting of the funding repayment, and adjust their budget plans as necessary. This clarity can lead to an extra self-displined technique to saving and costs, inevitably adding to much better economic health and wellness. With installation fundings, the assurance of taken care of regular monthly settlements reduces anxiety concerning unforeseen costs, enabling consumers to concentrate on their purchases as opposed to financial uncertainties. Installment car loans supply a sensible solution for managing substantial expenses while keeping monetary responsibility.

Lower Passion Rates Compared to Credit Scores Cards

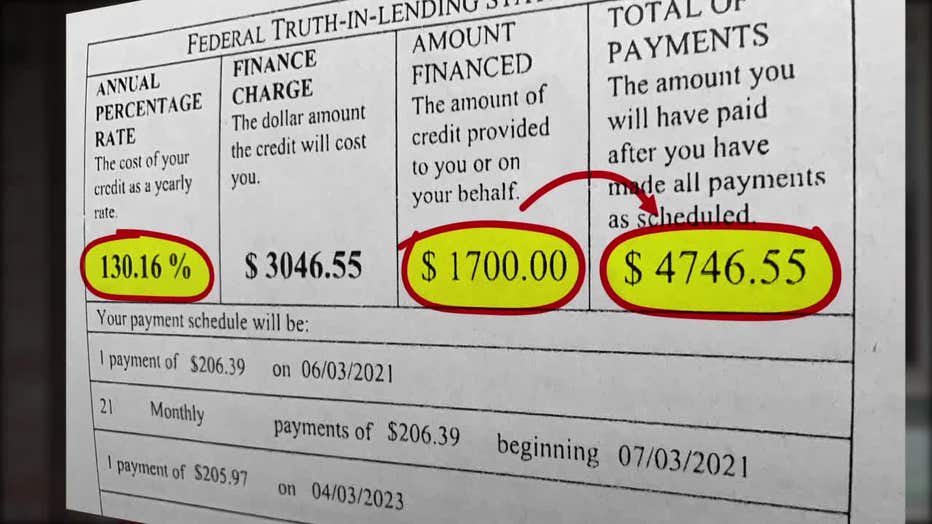

Installation fundings commonly include reduced rate of interest prices contrasted to charge card, making them an economically wise choice for significant purchases. Charge card generally carry higher interest rate (APRs), which can lead to substantial rate of interest charges if equilibriums are not settled promptly. On the other hand, installation loans often supply debtors with taken care of rates, permitting predictable payment terms over a specified duration. This can cause considerable cost savings, especially for high-ticket things like automobiles or home devices. In addition, the lower passion prices connected with installation finances can lessen the total monetary concern, making it possible for customers to manage their budgets better. This makes installation lendings an eye-catching choice for individuals wanting to make significant purchases without incurring excessive financial obligation. By choosing an installment finance, consumers can secure a much more desirable financial result while simultaneously appreciating the benefit of spreading payments in time.

Clear Finance Terms and Conditions

Recognizing the clear car loan conditions can significantly enhance a customer's economic decision-making procedure. Installment lendings typically use uncomplicated payment timetables, fixed rates of interest, and clear costs, which can make it much easier for consumers to comprehend their commitments. This clarity permits people to evaluate their ability to pay back the funding without the complication commonly connected with variable-rate credit items.

Clear terms assist consumers avoid prospective mistakes, such as hidden charges or unanticipated increases in monthly settlements. By understanding precisely what to expect, debtors can make educated choices regarding their financial dedications. Additionally, recognizing the lending problems fosters higher depend on between consumers and loan providers, as well-defined contracts lower the possibility of disputes. To conclude, clear lending terms empower consumers, allowing them to browse the loaning procedure with self-confidence and guarantee.

Improved Budgeting and Financial Planning

Installment fundings use customers foreseeable month-to-month settlements, which can substantially boost budgeting initiatives. This financial predictability permits much better money flow monitoring, allowing people to allocate resources better. Therefore, debtors can prepare for both immediate costs and future financial goals with greater self-confidence.

Predictable Month-to-month Settlements

They typically locate that foreseeable month-to-month settlements considerably improve their budgeting and economic planning efforts when people opt for installation fundings. This framework enables consumers to allot a specific quantity of their income each month towards funding repayment, decreasing the danger of unanticipated economic stress. By understanding the precise settlement due day and amount, individuals can prepare their expenses much more successfully, ensuring that they can fulfill both their funding obligations and other financial commitments. This predictability can bring about improved savings habits, as individuals are much less likely to overspend when they have a clear understanding of their monthly economic landscape. On the whole, foreseeable repayments cultivate a feeling of control and self-confidence in taking care of funds, making installment fundings an appealing option for significant purchases.

Boosted Money Flow Monitoring

Effective cash money flow monitoring plays a necessary duty in improving budgeting and economic preparation for individuals handling installation car loans. By damaging down the overall price of an acquisition into manageable monthly payments, debtors can assign their income better. This structured method enables people to prepare their costs, ensuring they have enough funds for both fixed and variable expenses every month. Additionally, understanding the exact settlement quantity makes it easier to anticipate future monetary commitments, minimizing the likelihood of overspending. With boosted capital management, debtors can keep a balanced budget, avoid late charges, and eventually pursue their economic goals with higher self-confidence. This clarity adds to an extra steady financial future and fosters accountable spending habits.

Quick Accessibility to Funds

Lots of consumers appreciate the benefit of quick access to funds when making substantial acquisitions. Installment financings supply a structured procedure that permits people to safeguard funding swiftly, Get More Information typically within a couple of days. This timely approval can be specifically beneficial for those encountering unforeseen expenditures or possibilities that need instant financial resources, such as acquiring a new lorry or home repair services.

Unlike typical lendings, which might include prolonged application processes and extensive paperwork, installation finances typically need marginal documents. This ease of access not just reduces the anxiety connected with urgent monetary needs however also allows consumers to act promptly in open markets. In addition, the simplicity of online applications enhances the rate of getting funds, permitting consumers to get needed funding immediately. To summarize, the quick availability of funds with installment fundings encourages consumers to make prompt choices pertaining to substantial purchases.

Versatility in Funding Quantities

Tailored Loan Solutions

While significant acquisitions commonly call for significant financial commitment, customized funding remedies provide customers with the ability to protect funds that line up with their certain demands. These remedies permit people to pick car loan amounts that correspond to their purchasing power and monetary circumstance. By using a variety of alternatives, lending institutions can fit different spending plans, making sure that customers are not compelled right into a one-size-fits-all situation. Consumers can analyze their financial abilities and choose a car loan amount that lessens tension while making best use of acquiring possibility. This flexibility empowers them to make informed decisions, ultimately improving their total monetary wellbeing. Tailored finance options stick out as a useful selection, enabling even more workable financial planning and a smoother investing in experience.

Adjustable Payment Strategies

Adjustable layaway plan supply borrowers the opportunity to personalize their repayment framework according to their financial conditions. visit homepage This flexibility allows individuals to choose loan amounts and payment routines that line up with their revenue and monetary requirements. For circumstances, customers may choose to make smaller sized payments over a longer duration or larger payments in a shorter timeframe, depending upon their preferences. This versatility can substantially reduce economic tension, enabling debtors to manage their regular monthly expenses much more efficiently. Adjustable repayment plans can accommodate life adjustments, such as task changes or unforeseen expenses, permitting borrowers to readjust their payments as needed. On the whole, this attribute boosts the overall accessibility and beauty of installation car loans for major purchases.

Diverse Funding Options

Numerous installment loans supply diverse funding choices, allowing debtors to pick loan quantities that ideal suit their certain demands. This adaptability is specifically useful for people making considerable acquisitions, such as automobiles or home improvements. By offering various car loan quantities, lending institutions make it possible for borrowers to avoid tackling unneeded financial obligation while guaranteeing they can secure the essential funds. Additionally, borrowers can customize their car loans to match their economic capacities, lowering the danger of default. This flexibility also motivates responsible loaning, as people can select amounts that align with their spending plans and repayment plans. As a result, varied funding options empower customers to make educated financial decisions, improving their overall getting experience.

Possibility to Construct Credit Score Background

Developing a robust debt background is a significant advantage of making use of installation finances for major purchases. By securing an installation lending, borrowers have the opportunity to demonstrate their credit reliability with regular, on-time repayments. This regular repayment habits positively affects credit report, which are essential for future monetary undertakings.

Unlike revolving credit score, such as bank card, installation loans have taken care of settlement routines, making it much easier for debtors to manage their finances and assurance prompt repayments. Each successful repayment not only develops credit rating background but additionally boosts count on with future lending institutions.

Moreover, a strong credit scores history can result in better rate of interest and financing terms in the future, providing additional economic benefits - Installment Loans. For people wanting to make significant acquisitions, such as a home or automobile, establishing a solid credit structure More hints through installment lendings can be a calculated economic step, paving the method for more considerable borrowing opportunities down the line

Often Asked Inquiries

What Kinds of Acquisitions Are Finest Fit for Installment Loans?

Big purchases such as lorries, home remodellings, and expensive home appliances are best suited for installation loans. These items frequently require significant investment, making workable monthly settlements a lot more financially feasible and enticing for customers.

How much time Does the Authorization Refine Commonly Take?

The approval process for installation car loans normally takes anywhere from a couple of minutes to a number of days, depending upon the lender's demands, the candidate's credit reliability, and the complexity of the monetary info offered during the application.

Can I Repay an Installation Car Loan Early Without Penalties?

Numerous lenders enable early settlement of installation loans scot-free, but certain terms vary. Borrowers ought to examine their funding arrangements or consult their lenders to understand any prospective fees related to early payback.

What Happens if I Miss a Payment?

Missing a settlement on an installation car loan may lead to late charges, enhanced rate of interest prices, and prospective damages to credit history scores. Lenders may likewise start collection actions, impacting future loaning possibilities for the consumer.

Are There Any Covert Charges With Installment Loans?

Covert fees can sometimes go along with installment financings, consisting of source charges, late repayment charges, or prepayment fees. Borrowers need to completely evaluate car loan arrangements and ask lenders regarding any possible costs before devoting to a funding.

With installment finances, the certainty of dealt with regular monthly payments reduces anxiousness about unforeseen expenses, enabling customers to focus on their purchases rather than economic unpredictabilities. When people opt for installation finances, they often discover that foreseeable monthly repayments greatly improve their budgeting and economic preparation efforts. Unlike standard car loans, which may include extensive application procedures and comprehensive paperwork, installment lendings generally need very little documents. Versatility in car loan quantities is an important function of installment finances, enabling customers to locate tailored options that meet their particular financial demands. Several installment loans provide diverse funding alternatives, enabling customers to choose lending quantities that best match their particular demands.